With the resignation of the acting head of the Internal Revenue Service (IRS) over a series of audits of conservative organizations, the agency is under intense public scrutiny. Ai??But this furor ignores little-noticed numbers released last month — they show that the IRS’s audits of wealthy taxpayers revealed massive tax-dodging by the richest Americans.

With the resignation of the acting head of the Internal Revenue Service (IRS) over a series of audits of conservative organizations, the agency is under intense public scrutiny. Ai??But this furor ignores little-noticed numbers released last month — they show that the IRS’s audits of wealthy taxpayers revealed massive tax-dodging by the richest Americans.

In 2012, the IRS ramped up its audits of wealthy taxpayers, and shockingly found a massive rate of under-paying taxes. It audited one in eight tax filers with incomes over $1 million, concluding that about 75 percent of these millionaires failed to pay the taxes they owed. Altogether, the agency collected an additional $4.8 billion in taxes from these taxpayers after the audits were conducted.

As the press and politicians look at the IRS’s conduct with regards to auditing political nonprofits, it’s important to remember that these audits can be a powerful tool for making sure that wealthy taxpayers are paying what is legally required of them. If last year’s numbers are any indication, increasing audits of wealthy taxpayers will reveal under-payment and help us raise the money needed to fund the government.

Today is tax day, the deadline for filing your tax return. While millions of Americans are doing their patriotic duty and paying their taxes through the year, wealthy individuals and corporations have made an art out of dodging their tax responsibilities.

Today is tax day, the deadline for filing your tax return. While millions of Americans are doing their patriotic duty and paying their taxes through the year, wealthy individuals and corporations have made an art out of dodging their tax responsibilities.

Congressional Republicans are

Congressional Republicans are  It is a frequent conservative mantra that government taxation and regulation prevent economic growth. EconomistsAi??Atif Mian and Amir Sufi looked at this claim for a

It is a frequent conservative mantra that government taxation and regulation prevent economic growth. EconomistsAi??Atif Mian and Amir Sufi looked at this claim for a

A new report finds that states are actually being denied billions of due to rich individuals and large corporations using offshore tax havens.

A new report finds that states are actually being denied billions of due to rich individuals and large corporations using offshore tax havens. Some on the right like to claim that the poor do not pay taxes. A

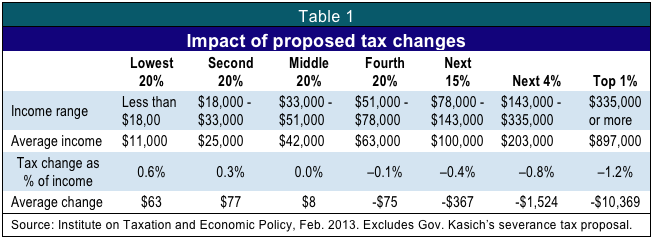

Some on the right like to claim that the poor do not pay taxes. A