In November, congressional leaders went on offense. Senators Tom Harking and Sherrod Brown introduced a bill to [expand] Social Security [benefits]. Elizabeth Warren took to the floor to declare that the tide had changed. Unions rallied their members to flood Congress with calls, and Progressive Change Campaign Committee, Move On and others gathered millions of signatures for petitions (while at 360,000, Fix the Debt fell far short of its 10 million goal.)

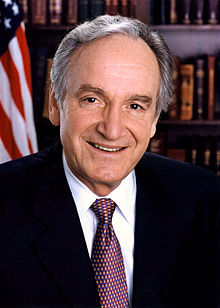

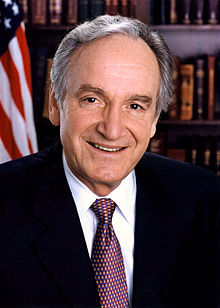

tom harkin

TEARFUL PLEA: Woman Breaks Down To Lawmaker

It was Democrat versus Democrat at times during Iowa Senator Tom Harkinai??i??s event in a Des Moines retirement center Tuesday. But a womanai??i??s emotional plea for help is what captured the attention of room full of dozens of retirees.

Harkin hosted the event with a number of Democratic-friendly groups, including the Iowa Alliance for Retired Americans, Progress Iowa, The Progressive Change Campaign Committee, Democracy For America, MoveOn.org, Social Security Works, and Credo Action.

Harkin, as well as some speakers expressed frustration with President Barack Obamaai??i??s previous push to change the way the government determines the yearly increases in social security benefits.

Senator Tom Harkin Introduces Bill To Tax The Rich More To Increase Social Security Benefits

Sen. Tom Harkin (D-IA)

Many Republicans and even some Democrats have been talking about cutting Social Security benefits by raising the retirement age or using a Chained CPI to reduce payments.

But Senator Tom Harkin (D-IA) set himself apart today by introducing a bill to do the opposite — increase benefits. Under Harkin’s bill, the benefits formula would be readjusted in a way that boosts benefits to beneficiaries by an average of $70 a month. In order to fund this increase and to maintain Social Security benefits for decades to come, Harkin would lift the Social Security payroll tax cap, ensuring that income aboveAi??$113,700 would be taxed as well.

Senator Tom Harkin: No Deal Is Better Than The Deal Being Negotiated

Sen. Tom Harkin (D-IA)

There are reports that the White House is preparing to offer a deal that would only end the Bush tax cuts on incomes above $400,000 while enacting a watered-down estate tax. These measures offer a major tax cut to the rich over what is currently set to take place in 2013 — tomorrow.

Senator Tom Harkin (D-IA) took to the floor just now and denounced this sort of deal:

HARKIN:Ai??Mr. President, I was disturbed to read in The Washington Post this morning that some kind of agreements are being made here. Somehow that democrats have agreed to raise the level of, from $250,000 to $450,000, and that somehow there’s been an agreement reached that we would keep the estate taxes at the $5 million level, at 35%. Mr. President, this is one Democrat that doesn’t agree with that at all.

[…]Ai??Again, if we’re going to have some kind of a deal, the deal must be one that really does favor the middle class, the real middle class, those that are making $50,000, $60,000, $70,000 a year. that’s the real middle class in america. As I see this thing developing, quite frankly, as I’ve said before, no deal is better than a bad deal. and this looks like a very bad deal the way this is shaping up.

Watch it: